Inflated Dreams: How Bad Money Policy Ruined Australia's Housing Market

Pristine beaches, stunning landscapes, cricket on Christmas, and ever-appreciating house prices. These have long been cornerstones of Australian culture, now considered almost unquestionable.

House prices rise because, well, they always have, and since the 1970’s the formula for Australian success has been straightforward:

- Get any job.

- Buy a house with leverage.

- Pay off the loan, sell the house for a profit.

- Repeat steps 2 and 3.

This wealth creation scheme hasn’t just been a strategy for the past 50 years—it’s been a birthright.

What’s shocking is how many people take this as gospel. The idea that house-price-go-up is so deeply ingrained in our psyche and culture most people don’t even question it. But if you ask them why housing has become so unaffordable, especially since 2020, you’ll likely hear one of the following explanations:

- Property Investors

- Immigration

- Building costs

- Negative Gearing/Tax Concessions

I’m not denying these factors play a role, but they’re secondary to the real culprit. The crisis in Australian housing starts with our flawed monetary policy.

Every year, the amount of Australian dollars in circulation increases by an average of 7%. When savings are diluted and purchases power decreases, we’re incentivised to store our wealth in assets that can’t be easily replicated—like gold, real estate, and equities.

Real estate, in particular, is used more so as a store of value in Australia compared to other Western nations for the following reasons:

- Our equities market isn’t as deep or liquid as others (ASX at \(1.5T vs. the U.S. at \)50T).

- Construction costs are higher.

- Zoning regulations are stricter, often driven by NIMBY (Not In My Backyard) sentiment.

Given that its hard to build new dwellings, housing has the perfect combination of scarcity and undeniable utility.

The key takeaway is this: House prices didn’t soar because they became investment assets; they became investment assets once people saw them as a superior store of value to our dollar. This incentivised shift in attitude opened the door to financialisation.

In response to COVID, stimulus checks and corporate bailouts increased our money supply by around 40%. Predictably, the housing market followed suit, going ballistic. Our median house prices surged by 40% since the pandemic, illustrating that cheap Australian money will always flow into scarce Australian real estate.

To combat inflation, the 13 rate hikes imposed by the RBA are by design making life tougher for Australians. A generation of new homeowners, burdened with large debt balances, now find themselves hanging on for dear life, hit hardest by the interest rate policy. Yet, the market remains irrationally composed. Many who are drowning in mortgage payments choose not to sell and rent for one simple reason: they all believe house prices will always rise in value. If they can just weather the storm and make it over the hill, their house will appreciate and they’re in the market for good – it’s an ingrained mindset.

Where do we go from here?

Since housing has been declared a national crisis by the Albanese government, let’s examine the role they play in this.

Supply – The government is entirely subservient to NIMBYs (Not In My Backyard advocates). We lack genuine private property rights in Australia, and as a result, we cannot build enough dwellings (specifically apartments) to meet demand.

Demand – Hand out taxpayer money to first homebuyers trying to enter the housing market. What a brilliant idea! So sustainable, right? What could possibly go wrong?

These two strategies highlight just how inept the Australian government is at addressing the housing crisis. They’re also incentivised by the following:

- The fastest way to a single term in office is through stagnant house price growth.

- A decrease in house prices is a decrease in revenue (land tax, stamp duty, council rates etc)

This Isn’t Looking Pretty

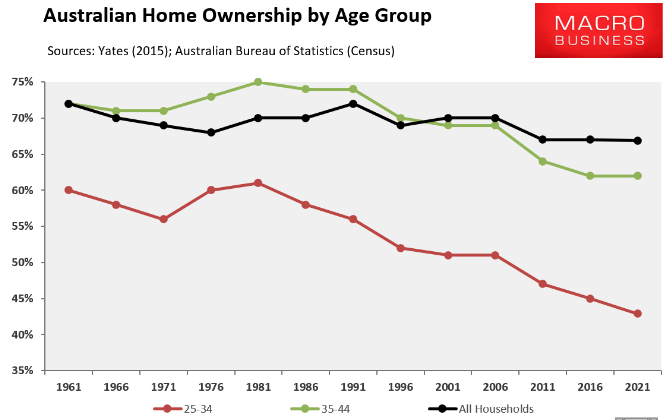

The younger you are, the more likely you are being completely priced out of the housing market, relegating Gen Z to Gen Renters.

Australian home ownership decrease

Australian home ownership decrease

The traditional Australian model of paying off your home and relying on a pension or superannuation to fund your retirement is now fundamentally broken. If you’re still paying a mortgage past 65, your superannuation alone won’t provide for a comfortable retirement. This is yet another example of the fiat treadmill speeding up, leaving everyday Australians scrambling to keep pace.

The Sound Money Alternative

In an ideal world of sound money, housing doesn’t become an investment. No homebuyer would be competing with private equity firms and a slew of housing investors. Even negative gearing wouldn’t exist. This simple move relegates housing to it’s intended purpose, a dwelling. In my mind this sounds great, but I wonder if this sound money already exists? #bitcoin

Colin Gifford