BitcoinFriday on Nostr: 🧠Quote(s) of the week: "How it will play out: 1. Bitcoin Halving in 67 days; ...

🧠Quote(s) of the week:

"How it will play out:

1. Bitcoin Halving in 67 days; Bitcoin halving sparks anticipation and price speculation.

2. BTC surpasses the market cap of gold; Bitcoin's market cap surpasses gold, signaling a significant milestone.

3. Game theory between countries starts; Strategic game theory dynamics emerge among nations regarding Bitcoin.

4. Every Central Bank starts to print; Central banks resort to increased money printing, potentially fueling inflation fears.

5. BTC gets seized on exchanges and ETFs; Regulatory scrutiny intensifies, leading to the seizure of Bitcoin on exchanges and ETFs.

6. Self-custody becomes illegal; Authorities impose restrictions on the self-custody of cryptocurrencies.

7. CBDC gets introduced; Central Bank Digital Currencies (CBDCs) are introduced, challenging Bitcoin's decentralized nature.

8. Plebs move to countries that allow BTC; Individuals seek residency in countries with favorable Bitcoin regulations.

9. Woke people lose trust in the CBDCs; Growing disillusionment with CBDCs among informed individuals.

10. BTC becomes global money; Bitcoin gains broader acceptance as a global medium of exchange and store of value."

🧡Bitcoin news🧡

Before I kick off with today's Weekly Recap I start with a great quote by Dr. Jeff Ross:

"I’m not sure who needs to hear this today, but the Bitcoin bull market hasn’t even started yet.

Instead of fixating on price, I suggest the following:

- Head down

- Work hard

- Stack sats (while they’re still super cheap)"

➡️Bitcoin Market Cap is now the 10th largest asset in the world by market capitalization, surpassing giants such as JPMorgan, Berkshire Hathaway, Tesla, and Visa.

➡️Wall Street ETFs are buying 12.5x more Bitcoin per day than the network can produce, increasing the demand and price. Hello, supply shock!

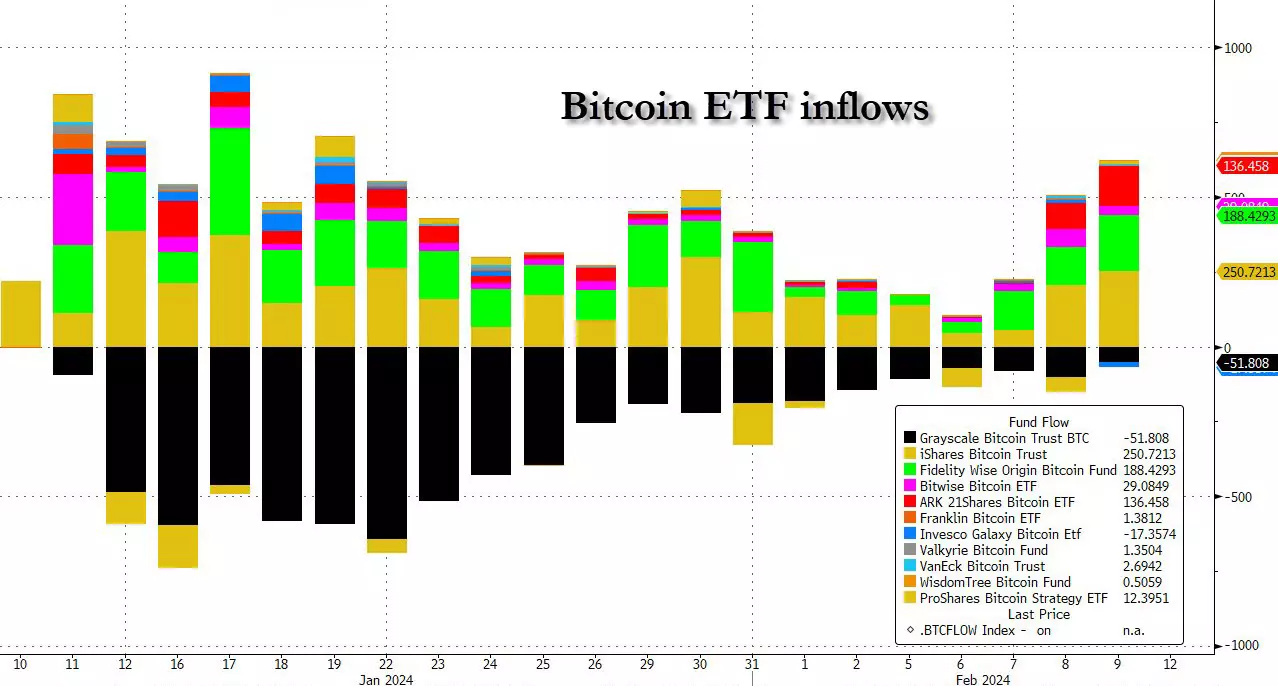

➡️Bitcoin ETF inflows are accelerating and so is the price of Bitcoin. Today ETF inflows broke $500m in one day. Meanwhile, retail is completely sidelined. Wait before the FOMO really kicks in. (picture 4)

➡️BlackRock now holds $4.1 billion worth of Bitcoin.

The 9 new Bitcoin ETFs now hold more than $10 BILLION in assets.

Ergo: Wall Street loves Bitcoin.

"Proof: There’s been over 5500 ETF launches in history.

NEVER before has an ETF reached $3 Billion AUM in less than 30 days… until now.

Both Blackrock and Fidelity’s Bitcoin spot ETFs have just done it."

➡️"Bitcoin has had a great run of +20% in 18 days. What happens next? This type of rally has happened 440+ times in the past 9 years.

-> continued up 88% of the time

-> typical gain +20% => $60k

-> only 6-12% downside historically.

So a non-trivial possibility of a new ATH in perhaps 30 days?" -Timothy Peterson

➡️92.75% of the Bitcoin circulating supply is now in profit.

Values above 95% have historically indicated local tops, and the last time this threshold was reached was during November 2021's all-time high of $69K.

➡️"This is what Bitcoin looks like for the citizens of Turkey, Egypt, Nigeria, Argentina, Lebanon, and Pakistan.

A combined population of 725 MILLION people.

Nigeria and Argentina prices more than doubled since I posted this 2 months ago."

https://twitter.com/TheRealTahinis/status/1756709193904439560

➡️Less than 10,000 blocks remain until the Bitcoin halving. The halving is scheduled for April 2023.

"There is an absolutely relentless pursuit for blocks with a block subsidy of 6.25 BTC.

In a couple of months, miners will be forced to only reward themselves with a subsidy of 3.125 BTC.

Bitcoin is in high demand, and it's about to get even more scarce." - Joe Burnett

➡️79.26% of Bitcoin haven't changed hands in the last 6 months.

➡️Americans could have saved at least $74 billion in 2022 by using cryptocurrency payment systems instead of credit cards, according to Coinbase’s “State of Crypto” report.

➡️On the 10th of February, Ark became the third Bitcoin ETF to pass $1 billion in Bitcoin holdings.

➡️ World's largest asset manager BlackRock says Bitcoin is creating a "global internet of value."

➡️Bitcoin hashrate at a new all-time high! (picture 3

➡️The world’s largest Bitcoin mine begins construction in Texas.

Riot's Corsicana Facility will harness an impressive one gigawatt of electricity. The project will cost an estimated $333,000,000.

More miner news:

➡️America’s first nuclear-powered Bitcoin computer mine is online at the 2.5 gigawatt Susquehanna power plant in Pennsylvania.

Located at the 2.5 GW nuclear energy facility in the PJM interconnection is Nautilus Cryptomine, a Bitcoin mining facility jointly owned by

TeraWulf and Talen Energy.

- 16,000

Bitcoin machines

- 1,900,000,000,000,000,000x hashes per second at total capacity.

More miner news, now from Africa:

https://twitter.com/GridlessCompute/status/1756164755398578542

Nice drone shots of a hydropower station in Kenya by Gridless.

More miner news:

"Bitcoin mining now has lower emission intensity than any other industry.

It is literally the "Roger Bannister" of emission reduction, showing other industries that what was once thought impossible is possible.

full story and source data": - Daniel Batten

https://www.batcoinz.com/p/issue-001-the-narrative-is-shifting

➡️ Bitcoin whales are on the move as 1K-10K BTC wallets hit the highest since Nov '22 (1,958), while 100-1K BTC wallets see a new low (13,735). Bitcoin

whales have acquired 140K BTC ($6.16B) in the last three weeks.

➡️On the 6th of February: BlackRock's Bitcoin ETF is now among the Top 5 ETFs in year-to-date flows, indicating that it has attracted more cash than 99.98% of ETF

➡️ Michael Saylor’s MicroStrategy just bought another 850 Bitcoin worth $37.2m and now holds 190.000BTC.

The company is now at a $3,500,000,000 unrealized profit.

➡️El Salvador's Bitcoin portfolio is in the green with ~$21 million in gains.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have CPI, retail sales, industrial production, and PPI. In Europe, it’s the UK CPI, GDP, labor market data, and the German ZEW. In Asia, we have the Australian labor market report, India CPI, and Japanese GDP

👉🏽"The combined revenue of the 4 largest US companies hit a record $1.5 trillion over last 12 months...

Amazon: $575 billion

Apple: $386 billion

Google: $307 billion

Microsoft: $228 billion

That's larger than the GDP of all but 14 countries." - TKL

👉🏽"Nvidia, NVDA, is now the 4th most valuable public company in the world, worth $1.84 trillion.

Today, Nvidia's market cap passed both Google and Amazon for the first time in history.

Since January 1st, Nvidia has officially added $650 BILLION in market cap.

That's more than the entire value of Tesla in less than 6 weeks." - TKL

🏦Banks:

Last week I mentioned that the FED announced that the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11.

Last week we witnessed how New York Community Bank stock, NYCB, the bank that acquired the collapsed Signature Bank, fell 40% after earnings.

"On the 6th of February New York Community Bank stock NYSB, the bank that acquired the collapsed Signature Bank, crashed another 25%.

The stock is now down a massive 61% in 2024 to its lowest level since June 2000.

Currently, roughly 40% of NYCB's assets are not under FDIC insurance.

The stock's decline accelerated after the bank posted an unexpected $260 million loss in Q4 2023." - TKL

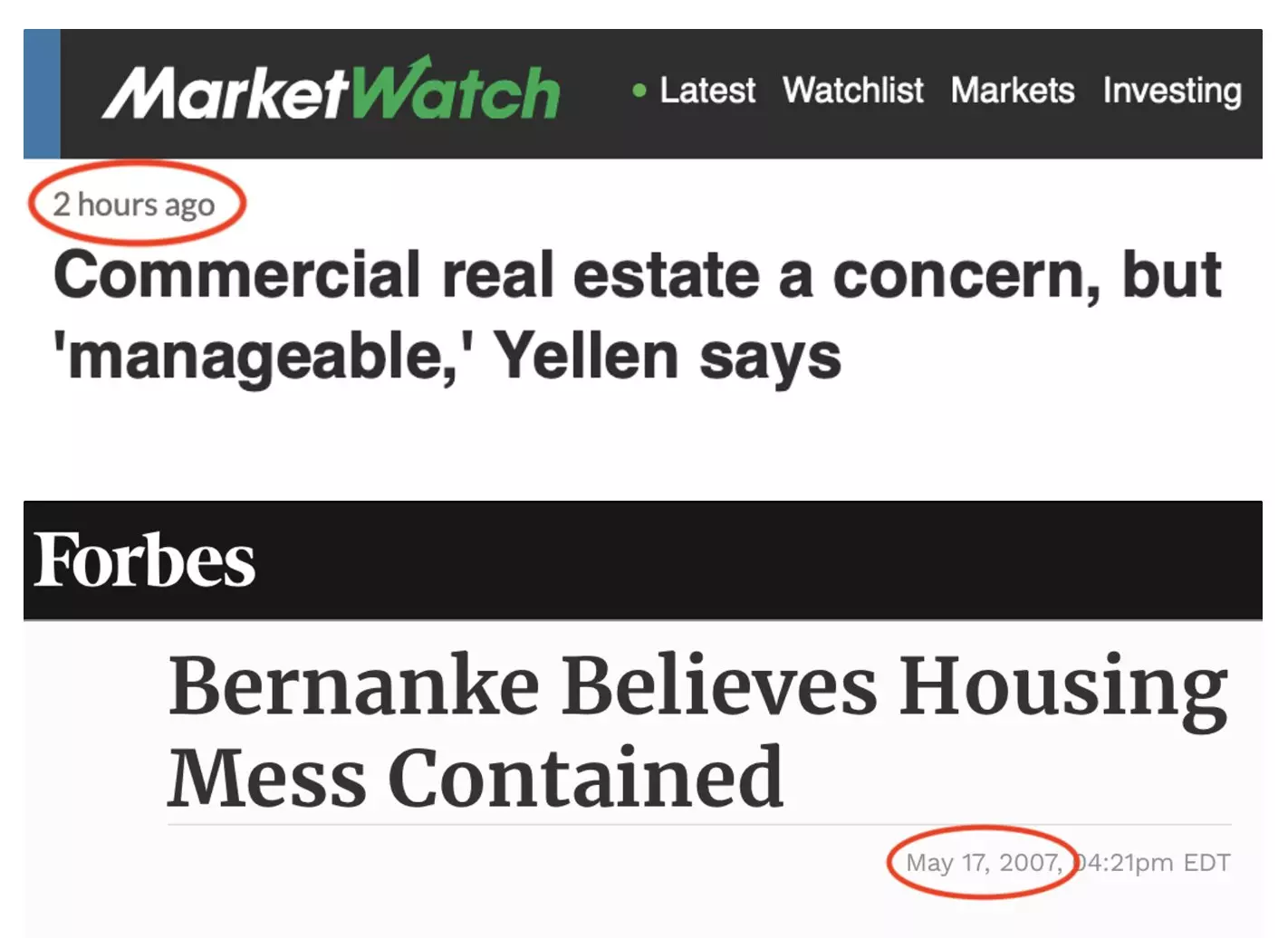

Please read the bit on commercial real estate in last week's Weekly Recap and... check out the picture. (picture 1)

US Regional Bank Stocks 1 Month Into 2024:

1. NY Community Bank, NYCB: -60%

2. Valley National Bank, VLY: -25%

3. Metropolitan Bank, MCB: -15%

4. HarborOne, HONE: -14%

5. Comerica Bank, CMA: -13%

6. Zions Bank, ZION: -12%

7. Western Alliance, WAL: -11%

8. Citizens Financial, CFG: -6%

9. KeyCorp, KEY: -5%

Regional bank worries resurfaced as New York Community Bank which acquired the collapsed Signature Bank, cut their dividend by 70%.

These are the same banks that hold nearly 70% of commercial real estate loans.

Just 10 months ago, the regional bank crisis "ended." - TKL

🌎Macro/Geopolitics:

👉🏽Another reason there's so much pressure for rate cuts:

Debt servicing costs on US debt have skyrocketed since the pandemic.

Servicing costs have gone from ~1.5% of GDP to nearly 3.0% of GDP since 2020.

According to US projections, debt servicing costs are set to rise by 3.5%.

For years, low-interest rates meant deficit spending was fairly "cheap."

Now, we are paying for years of historically low-interest rates.

The era of "free" money is over." - TKL

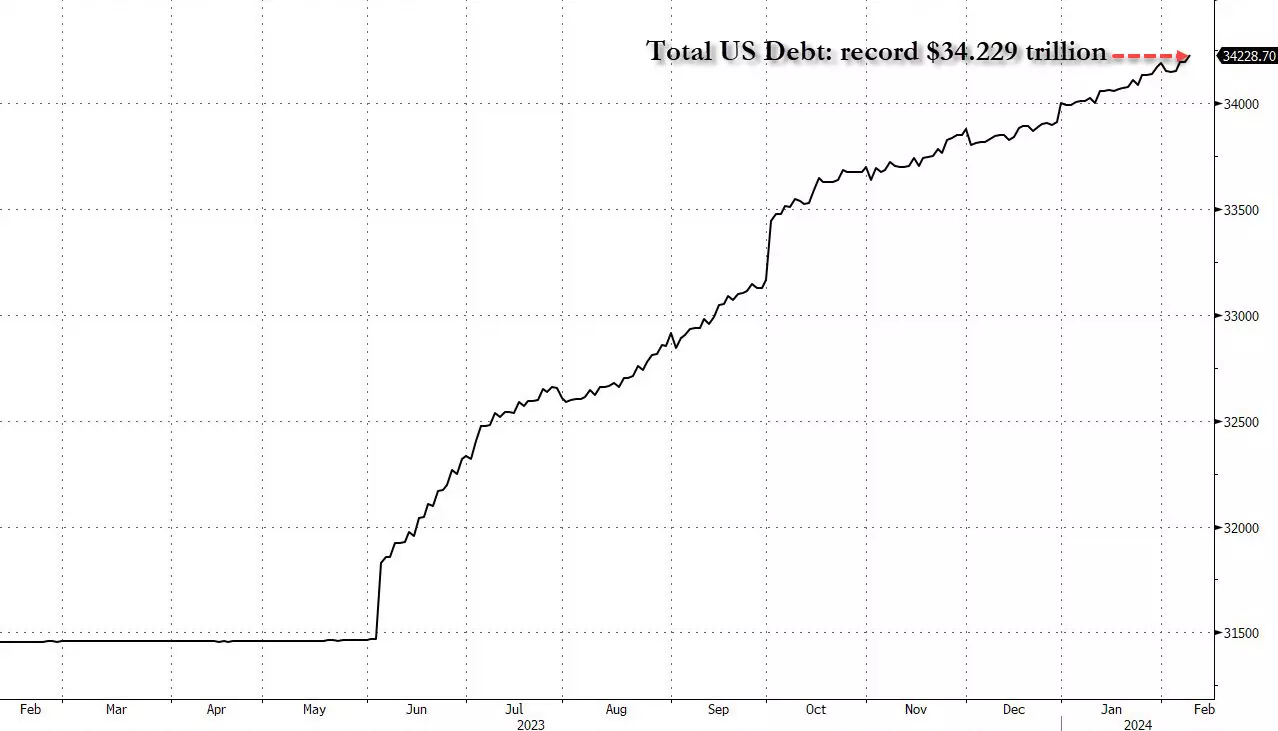

Total debt +$31BN today to a record high of $34.229 Trillion.

+$229 Billion since Jan 1

+$2.8 trillion in the past year.

$35 trillion by June.

BTC is worth less than 3% of the US national debt. Humanity holds ~37x more wealth in debt from a bankrupt government than in the world’s best money. we are so early!

"It took 17 years for the US to add $3.4 trillion of credit card debt, but less than 4 years for it to add another $340 billion.

Price increases are outpacing wage gains, and people are resorting to piling on credit card debt to pick up the difference."

(picture 2)

“The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy… We're borrowing from future generations,” says Fed chief Jerome Powell.

👉🏽Combine the above with the following statement:

The US Office of Management and Budget has said they see a deficit at 5%+ of GDP through 2033.

This means that a budget deficit of $1.4 trillion is expected in 2024.

By 2033, projections show that deficit spending will equal 6.9% of GDP.

There have only been 5 times in US history where deficit spending hit 6.5%+.

In 2033, this would imply an annual budget deficit of $2.7 trillion.

I don't want to be doom & gloom, but can anyone tell me how this can end well?

The debt is growing at ~10% per tear, plus a debasing currency, plus global competition intensifying.

👉🏽"While the rest of the world battles inflation, China is battling DEFLATION.

China's CPI just fell by 0.8% with prices suffering their biggest drop since the global recession in 2009.

This also marked the 4th consecutive monthly decline in China's CPI.

Weak consumer demand has been weighing on prices with prices of many food items falling by double-digit percentages.

The price of pork plunged by 17% and vegetable prices slid nearly 12%.

The economic slowdown continues." TKL

👉🏽Everyone could have seen this a mile away. Many choose not to look:

https://twitter.com/LukeGromen/status/1756343413253812722

More news on the sick man of Europe, Germany.

Its days as an industrial superpower are coming to an end. As pol paralysis grips Berlin, the energy crisis was the final blow for a growing number of manufacturers. German comps pay some of the highest electricity prices in the EU. https://www.bloomberg.com/news/features/2024-02-10/why-germany-s-days-as-an-industrial-superpower-are-coming-to-an-end

The risk of recession has increased significantly. Economists polled by BBG see the probability of a recession happening over the next 12 months at 75%.

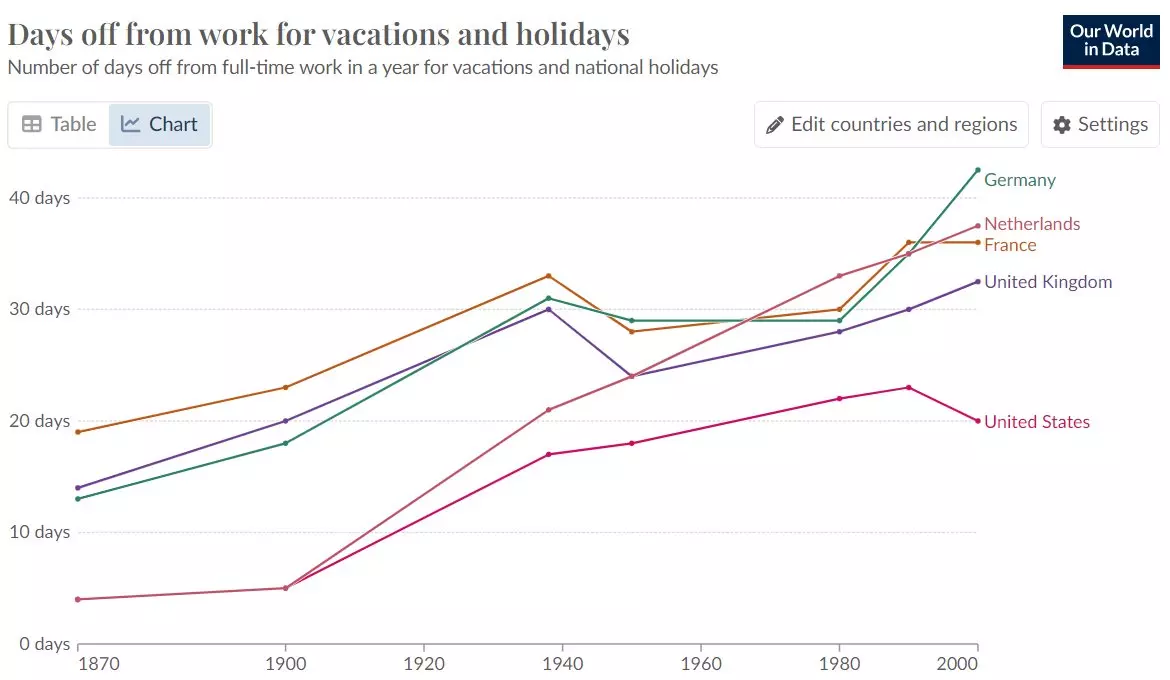

"While US growth continues to positively surprise, the Eurozone goes in the opposite direction. But hey, let’s add some more regulations in Europe and decrease working time to four days per week." - Michael Arouet

(picture 5)

This chart ends in 2000, but I believe what it illustrates remains true today.

https://ourworldindata.org/working-hours

👉🏽https://twitter.com/LukeGromen/status/1757076757977387164

🎁If you have made it this far I would like to give you a little gift:

https://www.youtube.com/watch?v=DnBuIla9nGU&t=3s

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption