BitcoinFriday on Nostr: Weekly Recap: 20.02.2024 🧠Quote(s) of the week: "The scarcity of money controlled ...

Weekly Recap: 20.02.2024

🧠Quote(s) of the week:

"The scarcity of money controlled by no human being vs. the infinity of money manipulated and controlled by a small group of privileged men we don't even vote for.

I know which one I choose.

Bitcoin only." -Oliver L. Veleze

🧡Bitcoin news🧡

➡️https://www.pricedinbitcoin21.com/chart/housing/MSPNHSUS

The prices of homes just keep getting more and more affordable...

Affordable in Bitcoin terms.

This is exactly what Jeff Booth is talking about when he says Bitcoin is repricing everything…This is what happens when technology drives prices down and you have a currency that doesn’t steal from you. I urge you to read his book 'The Price of Tomorrow': https://cryptofriday.eu/index.php/books-articles/

➡️Michael Saylor, CEO of MicroStrategy, made headlines on Wall Street in 2020 by converting his company's cash reserves to Bitcoin.

Financial experts laughed at the idea.

Today, his Bitcoin is worth $10,000,000,000.

➡️"Last week's (tweet by therationalroot) Bitcoin ETF data is in:

- ETF Net In-Flows consistently over +6K BTC this week

- Cumulative holdings at All-Time-High of 726K BTC

- Cumulative holdings up 100k BTC since launch

- BlackRock alone added over 30k BTC this week

- Grayscale down 166k since launch"

Bitcoin ETFs have taken in over $3 BILLION of new funds in just the last 7 days. On the 14th of February, it was the biggest day of inflows since launch day, with $631m!

Bitcoin ETFs are catching up to Gold ETFs for assets.

$37b for BTC $93b for Gold; After just 25 trading days!

"Blackrock doesn't care about sound money or ending the Fed.

But when Blackrock ETF buys up 500K Bitcoin, the price goes to 1M.

Blackrock makes $1.25B in annual fees - forever.

Follow the money." - Thomas Fahrer

More on Blackrock...

➡️Bloomberg's Eric Balchunas reports that BlackRock's spot Bitcoin ETF has taken in $5.2 billion YTD, representing 50% of BlackRock's total net flows for their 417 ETFs.

More ETF news...

➡️A little perspective...

Bitwise the fourth largest of the new Bitcoin ETFs is buying up 880 BTC Per Day on Average.

Soon to be double the rate of Bitcoin mining supply.

➡️https://twitter.com/BitcoinNewsCom/status/1759027406956900716

Supply & demand. Please watch that clip. After watching that clip please have a look at the following tweet:

https://twitter.com/BLACK1W1/status/1758793481756307814

It boggles the mind. Really, please read the tweet.

➡️Bitcoin has officially crossed above $1 trillion in market cap for the first time since December 2021.

Since December 2022, Bitcoin has added ~$700 billion in market cap. Bitcoin is back.

➡️94.5% of the Bitcoin supply is now in profit. Despite Bitcoin moving from $16.5k to $52k in 13 and half months, the amount of coins that didn’t move in the last 12 months remains close to the ATH at 70%.

➡️Coinbase's Bitcoin supply plunges to the lowest since 2015 after 18K BTC (~$1B) withdrawal.

In general, Bitcoin on exchanges falls significantly over the weekend. Bitcoin on all exchanges even hit the lowest level since 2017. In connection with the increased demand by ETFs and the upcoming Bitcoin halving, there will be even fewer coins in circulation. Hello, supply SHOCK!

➡️Bitcoin is at all-time highs in the following countries:

Laos

Burundi

Malawi

Nigeria

Myanmar

Ethiopia

Pakistan

Cuba

Ghana

Egypt

Congo

Iran

Suriname

Sierra Leone

Turkey

Sudan

Syria

Argentina

Lebanon

Venezuela

➡️"It's a great business to be in, Central Banking, where you print money and people believe it"

"We are 𝗹𝗮𝘀𝗲𝗿 𝗹𝗶𝗸𝗲 𝗳𝗼𝗰𝘂𝘀𝗲𝗱 on being the most cost-effective, fit-for-purpose Central Bank we can be. We are a full-service bank."- Adrian Orr

https://twitter.com/MikeStillBTC/status/1757329415489401152

The person in the video is the Governor of the Reserve Bank of New Zealand. The same guy claimed that ‘bitcoin is neither a medium of exchange, a store of value or a unit of account’.

Anyway, once you learn how the system works...

Bitcoin.

"Central Bankers think YOU are so dumb that they can just say this kind of stuff out loud.

Bitcoin is YOUR proof that they can't keep getting away with this theft." - Preston Pysh

➡️Elizabeth Warren's inflated claims of crypto's use to fund terrorism were debunked at a Congressional hearing "Committee members put the final nail in the coffin of the hyperinflated fears surrounding crypto and illicit finance" said Taylor Barr.

Meanwhile...

➡️Three more US states (Ohio, South Carolina, Mississippi) introduced the Blockchain Basics Act, aiming to protect citizens' Bitcoin rights at the state level.

➡️All-time high: Bitcoin Mining now offsets 7.5% of its emissions through methane mitigation.

Why it matters: COP28 was all about methane mitigation. Bitcoin Mining is uniquely poised to mitigate methane profitably

Full story & source: by Daniel Batten:

https://www.batcoinz.com/p/issue-002-all-time-highs

Bitcoin mining according to former CEO ERCOT (the guy who ran de grid of Texas. The reason why I am reposting so much stuff from Daniel Batten is that Bitcoin mining is so complex but also so important for Bitcoin but also our world.

https://twitter.com/DSBatten/status/1759107766189461916\

Please read his tweet and the provided sources. Literally every day there's new data, and new analysis showing how Bitcoin mining is a net positive green tech/user of energy.

➡️"The FTX bankruptcy estate sold more than $1 billion worth of GBTC.

Many have celebrated as GBTC Outflows have recently slowed, but unfortunately, there's more selling on the horizon.

Another bankruptcy estate plans to sell billions worth of GBTC soon- Genesis."

For more info, I urge you to read the following thread:

https://twitter.com/samcallah/status/1757445720880140555

➡️Bitcoin hit $50k.

Meanwhile, Google search volumes relative to price are at all-time lows. In other words, there is no retail FOMO buying.

➡️A coalition of leading banking and financial institutions has petitioned the SEC for an amendment to “SAB 121,” a regulation that has restricted banks from participating in the digital currency space.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have the latest Fed meeting minutes and jobless claims, Fed-speak, and PMI data. In Europe, the focus will be on inflation expectations, PMI data, and communication from ECB officials. In Asia, with central bank meetings in Indonesia and Korea, and Australian wages data and RBA meeting minutes.

👉🏽"The combined revenue of the 4 largest US companies hit a record $1.5 trillion over last 12 months...

Amazon: $575 billion

Apple: $386 billion

Google: $307 billion

Microsoft: $228 billion

That's larger than the GDP of all but 14 countries." - TKL

👉🏽"Since February 2023:

1. Magnificent 7: +77%

2. S&P 500: +20%

3. Russel 2000: +5%

4. S&P 500 Equal Weight: +4%

If you remove the Magnificent 7 from the S&P 500, the index is barely up 5% over the last year.

n other words, if you bought all S&P 500 stocks other than tech last year at this time, you're almost breaking even.

The top 10 stocks in the S&P 500 now account for a record 35% of the ENTIRE index." - TKL

🏦Banks:

no news

🌎Macro/Geopolitics:

👉🏽US inflation: Both headline and core CPI came in above consensus expectations.

Core CPI growth is proving particularly sticky. The money supply is soon expected to return to growth again. The potential risk of inflationary impulse remains.

This is super core inflation - a measure of sticky inflationary pressures Powell & Co. often refer to:

https://twitter.com/MacroAlf/status/1757414499684905372

Ergo: we are not out of the (inflation) woods!

👉🏽"Prediction markets are now pricing in just 4 rate cuts in 2024 after January CPI inflation hits 3.1%.

This is a huge slide in expectations as markets were pricing in 6 rate cuts just over a month ago, according to Kalshi. The most recent Fed guidance was for 3 interest rate cuts in 2024.

Odds of a March interest rate cut are below 10% and odds of a May rate cut are plummeting." - TKL

Personally, I think with the upcoming US election I don't expect any rate cuts till Q4 24.

👉🏽German banks prepare for huge loan defaults in ‘greatest real estate crisis since the financial crisis’ - CNN

Now you might think this is a German bank's problem. Well, that's true. But it is the US Commercial Real Estate defaults that are putting pressure on German banks if anyone is wondering:

https://edition.cnn.com/2024/02/07/business/pbb-bad-loans-real-estate-crisis/index.html

Something (CRE) I discussed in my recent Weekly Recaps. The main question is, how many other countries will experience this?

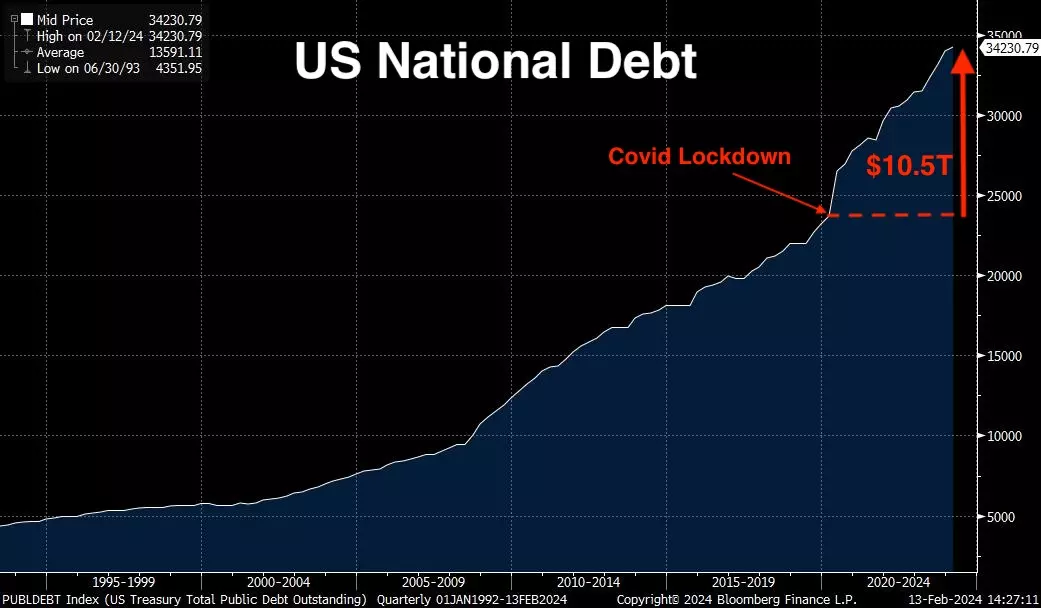

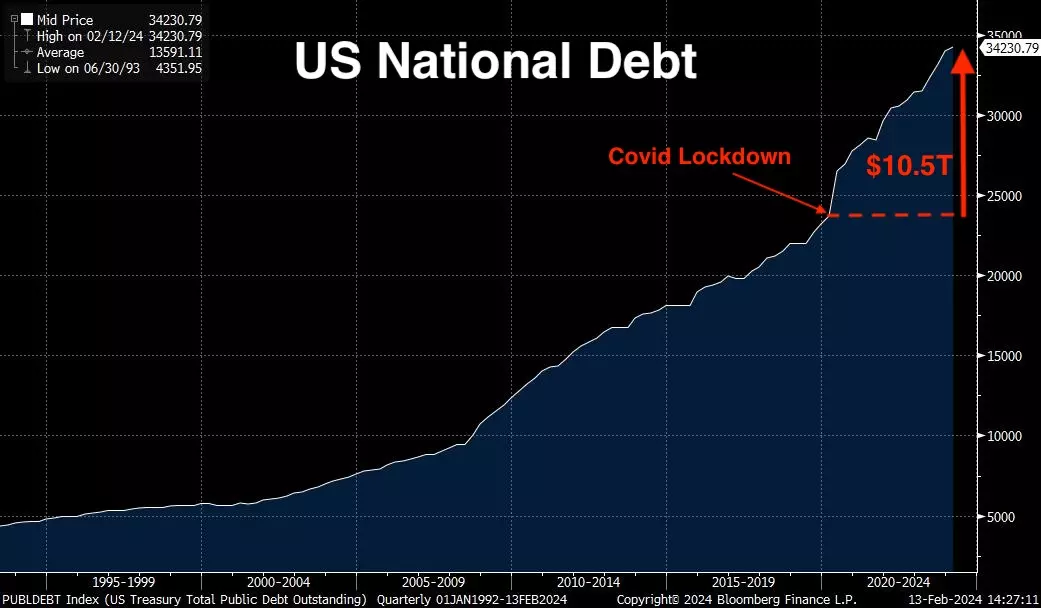

👉🏽https://twitter.com/jameslavish/status/1757535468449865801

(picture1)

Total debt +$31BN today to a record high of $34.229 Trillion.

BTC is worth less than 3% of the US national debt. Humanity holds ~37x more wealth in debt from a bankrupt government than in the world’s best money. we are so early!

👉🏽Current economies in recession:

Peru

Japan

Ireland

Estonia

Finland

Moldova

Denmark

Luxembourg

United Kingdom

China and Germany are in trouble.

👉🏽After 2 months of the Milei presidency:

- Financial surplus: “Argentina Sees First Monthly Budget Surplus In 12 Years”.

- 7 billion USD in reserves

- BCRA's liabilities are being liquidated

- Monetary base almost stalled in nominal terms

- Lower exchange rate gap

- National public spending is down

- Provinces are also beginning to spend less

- Inflation is slowing

- Country risk index lower

- S&P Merval strong pump in USD

👉🏽Direct foreign investment into China slumps to 30y low. Foreign firms only added $33bn to their FDI liabilities, the lowest since 1993, indicating a lack of confidence. China’s direct investment liabilities in its balance of payments stood at $33 billion last year, according to data from the State Administration of Foreign Exchange released Sunday. That measure of new foreign investment into the country — which records monetary flows connected to foreign-owned entities in China — was 82% lower than the 2022 level and the lowest since 1993.

source: https://archive.ph/R7dOj#selection-4869.0-4879.263

🎁If you have made it this far I would like to give you a little gift:

The Bitcoin Scaling Dilemma with Shinobi.

- Scaling Bitcoin with covenants

- A path to Bitcoin upgrades

- Ossification vs scaling sovereignty

- Risks for Bitcoin developers

https://www.youtube.com/watch?v=seOK8CujQQI

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption

🧠Quote(s) of the week:

"The scarcity of money controlled by no human being vs. the infinity of money manipulated and controlled by a small group of privileged men we don't even vote for.

I know which one I choose.

Bitcoin only." -Oliver L. Veleze

🧡Bitcoin news🧡

➡️https://www.pricedinbitcoin21.com/chart/housing/MSPNHSUS

The prices of homes just keep getting more and more affordable...

Affordable in Bitcoin terms.

This is exactly what Jeff Booth is talking about when he says Bitcoin is repricing everything…This is what happens when technology drives prices down and you have a currency that doesn’t steal from you. I urge you to read his book 'The Price of Tomorrow': https://cryptofriday.eu/index.php/books-articles/

➡️Michael Saylor, CEO of MicroStrategy, made headlines on Wall Street in 2020 by converting his company's cash reserves to Bitcoin.

Financial experts laughed at the idea.

Today, his Bitcoin is worth $10,000,000,000.

➡️"Last week's (tweet by therationalroot) Bitcoin ETF data is in:

- ETF Net In-Flows consistently over +6K BTC this week

- Cumulative holdings at All-Time-High of 726K BTC

- Cumulative holdings up 100k BTC since launch

- BlackRock alone added over 30k BTC this week

- Grayscale down 166k since launch"

Bitcoin ETFs have taken in over $3 BILLION of new funds in just the last 7 days. On the 14th of February, it was the biggest day of inflows since launch day, with $631m!

Bitcoin ETFs are catching up to Gold ETFs for assets.

$37b for BTC $93b for Gold; After just 25 trading days!

"Blackrock doesn't care about sound money or ending the Fed.

But when Blackrock ETF buys up 500K Bitcoin, the price goes to 1M.

Blackrock makes $1.25B in annual fees - forever.

Follow the money." - Thomas Fahrer

More on Blackrock...

➡️Bloomberg's Eric Balchunas reports that BlackRock's spot Bitcoin ETF has taken in $5.2 billion YTD, representing 50% of BlackRock's total net flows for their 417 ETFs.

More ETF news...

➡️A little perspective...

Bitwise the fourth largest of the new Bitcoin ETFs is buying up 880 BTC Per Day on Average.

Soon to be double the rate of Bitcoin mining supply.

➡️https://twitter.com/BitcoinNewsCom/status/1759027406956900716

Supply & demand. Please watch that clip. After watching that clip please have a look at the following tweet:

https://twitter.com/BLACK1W1/status/1758793481756307814

It boggles the mind. Really, please read the tweet.

➡️Bitcoin has officially crossed above $1 trillion in market cap for the first time since December 2021.

Since December 2022, Bitcoin has added ~$700 billion in market cap. Bitcoin is back.

➡️94.5% of the Bitcoin supply is now in profit. Despite Bitcoin moving from $16.5k to $52k in 13 and half months, the amount of coins that didn’t move in the last 12 months remains close to the ATH at 70%.

➡️Coinbase's Bitcoin supply plunges to the lowest since 2015 after 18K BTC (~$1B) withdrawal.

In general, Bitcoin on exchanges falls significantly over the weekend. Bitcoin on all exchanges even hit the lowest level since 2017. In connection with the increased demand by ETFs and the upcoming Bitcoin halving, there will be even fewer coins in circulation. Hello, supply SHOCK!

➡️Bitcoin is at all-time highs in the following countries:

Laos

Burundi

Malawi

Nigeria

Myanmar

Ethiopia

Pakistan

Cuba

Ghana

Egypt

Congo

Iran

Suriname

Sierra Leone

Turkey

Sudan

Syria

Argentina

Lebanon

Venezuela

➡️"It's a great business to be in, Central Banking, where you print money and people believe it"

"We are 𝗹𝗮𝘀𝗲𝗿 𝗹𝗶𝗸𝗲 𝗳𝗼𝗰𝘂𝘀𝗲𝗱 on being the most cost-effective, fit-for-purpose Central Bank we can be. We are a full-service bank."- Adrian Orr

https://twitter.com/MikeStillBTC/status/1757329415489401152

The person in the video is the Governor of the Reserve Bank of New Zealand. The same guy claimed that ‘bitcoin is neither a medium of exchange, a store of value or a unit of account’.

Anyway, once you learn how the system works...

Bitcoin.

"Central Bankers think YOU are so dumb that they can just say this kind of stuff out loud.

Bitcoin is YOUR proof that they can't keep getting away with this theft." - Preston Pysh

➡️Elizabeth Warren's inflated claims of crypto's use to fund terrorism were debunked at a Congressional hearing "Committee members put the final nail in the coffin of the hyperinflated fears surrounding crypto and illicit finance" said Taylor Barr.

Meanwhile...

➡️Three more US states (Ohio, South Carolina, Mississippi) introduced the Blockchain Basics Act, aiming to protect citizens' Bitcoin rights at the state level.

➡️All-time high: Bitcoin Mining now offsets 7.5% of its emissions through methane mitigation.

Why it matters: COP28 was all about methane mitigation. Bitcoin Mining is uniquely poised to mitigate methane profitably

Full story & source: by Daniel Batten:

https://www.batcoinz.com/p/issue-002-all-time-highs

Bitcoin mining according to former CEO ERCOT (the guy who ran de grid of Texas. The reason why I am reposting so much stuff from Daniel Batten is that Bitcoin mining is so complex but also so important for Bitcoin but also our world.

https://twitter.com/DSBatten/status/1759107766189461916\

Please read his tweet and the provided sources. Literally every day there's new data, and new analysis showing how Bitcoin mining is a net positive green tech/user of energy.

➡️"The FTX bankruptcy estate sold more than $1 billion worth of GBTC.

Many have celebrated as GBTC Outflows have recently slowed, but unfortunately, there's more selling on the horizon.

Another bankruptcy estate plans to sell billions worth of GBTC soon- Genesis."

For more info, I urge you to read the following thread:

https://twitter.com/samcallah/status/1757445720880140555

➡️Bitcoin hit $50k.

Meanwhile, Google search volumes relative to price are at all-time lows. In other words, there is no retail FOMO buying.

➡️A coalition of leading banking and financial institutions has petitioned the SEC for an amendment to “SAB 121,” a regulation that has restricted banks from participating in the digital currency space.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have the latest Fed meeting minutes and jobless claims, Fed-speak, and PMI data. In Europe, the focus will be on inflation expectations, PMI data, and communication from ECB officials. In Asia, with central bank meetings in Indonesia and Korea, and Australian wages data and RBA meeting minutes.

👉🏽"The combined revenue of the 4 largest US companies hit a record $1.5 trillion over last 12 months...

Amazon: $575 billion

Apple: $386 billion

Google: $307 billion

Microsoft: $228 billion

That's larger than the GDP of all but 14 countries." - TKL

👉🏽"Since February 2023:

1. Magnificent 7: +77%

2. S&P 500: +20%

3. Russel 2000: +5%

4. S&P 500 Equal Weight: +4%

If you remove the Magnificent 7 from the S&P 500, the index is barely up 5% over the last year.

n other words, if you bought all S&P 500 stocks other than tech last year at this time, you're almost breaking even.

The top 10 stocks in the S&P 500 now account for a record 35% of the ENTIRE index." - TKL

🏦Banks:

no news

🌎Macro/Geopolitics:

👉🏽US inflation: Both headline and core CPI came in above consensus expectations.

Core CPI growth is proving particularly sticky. The money supply is soon expected to return to growth again. The potential risk of inflationary impulse remains.

This is super core inflation - a measure of sticky inflationary pressures Powell & Co. often refer to:

https://twitter.com/MacroAlf/status/1757414499684905372

Ergo: we are not out of the (inflation) woods!

👉🏽"Prediction markets are now pricing in just 4 rate cuts in 2024 after January CPI inflation hits 3.1%.

This is a huge slide in expectations as markets were pricing in 6 rate cuts just over a month ago, according to Kalshi. The most recent Fed guidance was for 3 interest rate cuts in 2024.

Odds of a March interest rate cut are below 10% and odds of a May rate cut are plummeting." - TKL

Personally, I think with the upcoming US election I don't expect any rate cuts till Q4 24.

👉🏽German banks prepare for huge loan defaults in ‘greatest real estate crisis since the financial crisis’ - CNN

Now you might think this is a German bank's problem. Well, that's true. But it is the US Commercial Real Estate defaults that are putting pressure on German banks if anyone is wondering:

https://edition.cnn.com/2024/02/07/business/pbb-bad-loans-real-estate-crisis/index.html

Something (CRE) I discussed in my recent Weekly Recaps. The main question is, how many other countries will experience this?

👉🏽https://twitter.com/jameslavish/status/1757535468449865801

(picture1)

Total debt +$31BN today to a record high of $34.229 Trillion.

BTC is worth less than 3% of the US national debt. Humanity holds ~37x more wealth in debt from a bankrupt government than in the world’s best money. we are so early!

👉🏽Current economies in recession:

Peru

Japan

Ireland

Estonia

Finland

Moldova

Denmark

Luxembourg

United Kingdom

China and Germany are in trouble.

👉🏽After 2 months of the Milei presidency:

- Financial surplus: “Argentina Sees First Monthly Budget Surplus In 12 Years”.

- 7 billion USD in reserves

- BCRA's liabilities are being liquidated

- Monetary base almost stalled in nominal terms

- Lower exchange rate gap

- National public spending is down

- Provinces are also beginning to spend less

- Inflation is slowing

- Country risk index lower

- S&P Merval strong pump in USD

👉🏽Direct foreign investment into China slumps to 30y low. Foreign firms only added $33bn to their FDI liabilities, the lowest since 1993, indicating a lack of confidence. China’s direct investment liabilities in its balance of payments stood at $33 billion last year, according to data from the State Administration of Foreign Exchange released Sunday. That measure of new foreign investment into the country — which records monetary flows connected to foreign-owned entities in China — was 82% lower than the 2022 level and the lowest since 1993.

source: https://archive.ph/R7dOj#selection-4869.0-4879.263

🎁If you have made it this far I would like to give you a little gift:

The Bitcoin Scaling Dilemma with Shinobi.

- Scaling Bitcoin with covenants

- A path to Bitcoin upgrades

- Ossification vs scaling sovereignty

- Risks for Bitcoin developers

https://www.youtube.com/watch?v=seOK8CujQQI

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption