asyncmind on Nostr: In Australian law, is there precedent to sue banks for delayed transactions? ...

In Australian law, is there precedent to sue banks for delayed transactions?

#BitcoinOffensive #LegalEagles #LegalBeagles #Useless #Lawyers

In Australia, while there isn't a specific legal precedent for individual customers successfully suing banks solely for delayed transactions, there are avenues to address such grievances. Regulatory bodies have taken action against banks for systemic failures, which can indirectly support individual claims.

Regulatory Actions:

ASIC vs. HSBC Australia: In December 2024, the Australian Securities and Investments Commission (ASIC) initiated legal proceedings against HSBC Australia. The allegations centered on HSBC's inadequate systems to prevent unauthorized transactions and delays in investigating customer reports, with some cases taking an average of 145 days to resolve.

ASIC vs. NAB: In November 2024, ASIC sued the National Australia Bank (NAB) and its subsidiary for failing to respond to 345 financial hardship applications within the legally mandated 21-day timeframe over a five-year period.

Consumer Protections:

Under the Australian Consumer Law (ACL), businesses, including banks, are prohibited from accepting payment for products or services if they do not intend to supply them as agreed or within a reasonable timeframe. While this primarily addresses goods and services, it underscores the expectation of timely fulfillment of contractual obligations.

Avenues for Redress:

Australian Financial Complaints Authority (AFCA): Individuals can lodge complaints with AFCA regarding issues like incorrect or delayed transactions. AFCA provides a platform for resolving disputes between consumers and financial institutions.

Legal Action: While direct legal action against banks for delayed transactions is uncommon, consumers may have grounds if they can demonstrate that delays resulted in financial loss or breach of contract. Consulting with a legal professional is advisable to assess the viability of such claims.

In summary, although direct legal precedents for suing banks over delayed transactions are limited, regulatory actions and consumer protection laws offer mechanisms to address and rectify such issues.

#BitcoinOffensive #LegalEagles #LegalBeagles #Useless #Lawyers

In Australia, while there isn't a specific legal precedent for individual customers successfully suing banks solely for delayed transactions, there are avenues to address such grievances. Regulatory bodies have taken action against banks for systemic failures, which can indirectly support individual claims.

Regulatory Actions:

ASIC vs. HSBC Australia: In December 2024, the Australian Securities and Investments Commission (ASIC) initiated legal proceedings against HSBC Australia. The allegations centered on HSBC's inadequate systems to prevent unauthorized transactions and delays in investigating customer reports, with some cases taking an average of 145 days to resolve.

ASIC vs. NAB: In November 2024, ASIC sued the National Australia Bank (NAB) and its subsidiary for failing to respond to 345 financial hardship applications within the legally mandated 21-day timeframe over a five-year period.

Consumer Protections:

Under the Australian Consumer Law (ACL), businesses, including banks, are prohibited from accepting payment for products or services if they do not intend to supply them as agreed or within a reasonable timeframe. While this primarily addresses goods and services, it underscores the expectation of timely fulfillment of contractual obligations.

Avenues for Redress:

Australian Financial Complaints Authority (AFCA): Individuals can lodge complaints with AFCA regarding issues like incorrect or delayed transactions. AFCA provides a platform for resolving disputes between consumers and financial institutions.

Legal Action: While direct legal action against banks for delayed transactions is uncommon, consumers may have grounds if they can demonstrate that delays resulted in financial loss or breach of contract. Consulting with a legal professional is advisable to assess the viability of such claims.

In summary, although direct legal precedents for suing banks over delayed transactions are limited, regulatory actions and consumer protection laws offer mechanisms to address and rectify such issues.

quoting nevent1q…ary5The Banking Protection Racket: How Australian Banks Exploit Fraud Prevention to Stall Bitcoin Adoption

#BankingMafia #FinancialFreedom #Bitcoin #Crypto #BankScam #WhereIsMyMoney #CorruptBanks #Decentralize #EndFiat #MoneyControl #DigitalGold #P2P #SelfCustody #FraudPrevention #FinancialSovereignty #BitcoinFixesThis #BankingCartel #CryptoAwareness #FiatIsDying #StopTheBanks

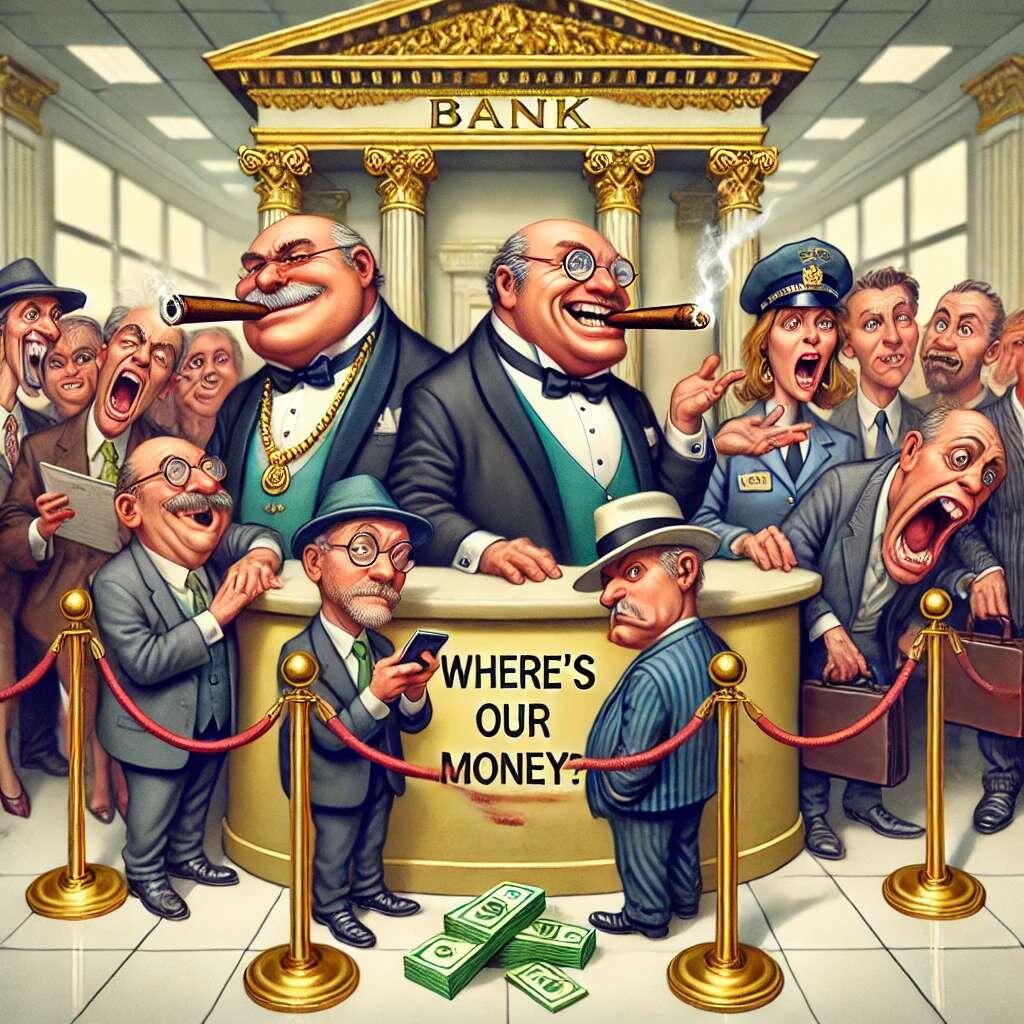

Introduction: A Legal Grey Area Protecting the Banking Mafia

Australian banks, like their global counterparts, routinely delay or block transactions to Bitcoin exchanges, claiming they are protecting customers from fraud. Yet, there is no clear legal precedent that allows banks to arbitrarily hold customer funds, especially when no fraud has occurred. The real reason for these delays is that banks view Bitcoin as an existential threat, and they leverage their political clout to maintain control over financial transactions.

This raises an urgent question: Can banks actually prove they are reducing scams, or is this a financial protection racket supported by corrupt institutions?

The Illusion of Fraud Prevention: Where’s the Data?

Banks justify their restrictions by citing “consumer protection,” yet they rarely provide transparent data proving that their actions reduce fraud. Instead, they:

Use vague statements about crypto scams to justify blanket transaction holds.

Enforce selective delays that impact Bitcoin purchases but rarely slow down gambling or high-risk speculative investments like penny stocks.

Act as both the judge and the enforcer, with no independent oversight.

If banks were truly committed to fraud prevention, they would:

Publish independent audits of their fraud mitigation strategies.

Apply equal scrutiny to all financial transactions, including fiat-based scams.

Provide rapid dispute resolution mechanisms for customers whose transactions are unjustly delayed.

Instead, what we have is selective enforcement designed to keep customers trapped in a failing fiat system.

The Political Clout of Banking Cartels

Banks do not operate in isolation. They have powerful lobbying groups that influence Australian policymakers, ensuring that regulations always favor them. Consider these facts:

The "Big Four" banks in Australia (Commonwealth Bank, Westpac, ANZ, and NAB) wield enormous influence over government policies through political donations and lobbying.

Regulatory capture ensures that financial watchdogs like AUSTRAC and ASIC rarely challenge the banks’ anti-crypto measures.

Governments and banks work together to maintain capital controls, making it difficult for individuals to move money freely.

This is nothing short of a legalized protection racket. Customers are coerced into relying on the banking system under the guise of "protection," when in reality, the system exists to maintain the banks’ monopoly.

What Can Individuals Do?

The good news is that individuals can fight back by pushing for financial accountability and systemic change. Here’s how:

1. Demand Transparency

Pressure banks and regulators to release fraud data specific to crypto-related transactions.

Call for third-party audits to verify whether these policies actually prevent scams.

2. Push for Legal Precedent

Support legal challenges that hold banks accountable for delaying legitimate transactions.

Advocate for stronger consumer protection laws that prevent banks from arbitrarily holding funds.

3. Exit the Banking System Gradually

Use peer-to-peer (P2P) Bitcoin purchases where possible.

Move savings into self-custody Bitcoin wallets to reduce dependency on banks.

Utilize the Bitcoin Lightning Network for payments to avoid banking delays altogether.

4. Spread Awareness & Organize Public Pressure

Educate others on how banks manipulate financial freedom under the guise of security.

Call out politicians who support banking overreach and push for financial competition.

Conclusion: A Fight Against Financial Oppression

Australian banks are not stopping fraud—they are stopping financial sovereignty. The delays on Bitcoin transactions are not about customer protection but about maintaining their monopolistic grip on money.

The solution? Push for transparency, demand legal accountability, and start exiting the traditional banking system. Bitcoin is the exit, but action is needed to break the banking mafia’s control.

It’s time to call their bluff.