asyncmind on Nostr: The Bitcoin reserve today mirrors the Gold reserve path of 1933 because both ...

The Bitcoin reserve today mirrors the Gold reserve path of 1933 because both represent state-controlled monetary consolidation, stripping individuals of financial sovereignty while empowering governments to dominate the financial system. Here’s how this leads to full-scale regulatory capture:

1. Centralization Through Confiscation or Coercion

In 1933, Executive Order 6102 forced individuals to surrender gold, allowing the government to seize monetary control and inflate the dollar without resistance.

Today, governments accumulate Bitcoin through confiscations (Mt. Gox, Silk Road seizures), taxation, and custodial regulations, slowly centralizing supply.

2. Suppression of Private Self-Custody

In 1933, private gold ownership was criminalized, forcing people into fiat.

Governments today demonize self-custody, promoting KYC-heavy, custodied Bitcoin solutions (ETFs, custodial wallets, regulated exchanges)—ensuring they have ultimate control.

3. Legal & Regulatory Capture

Once the U.S. centralized gold, it was easy to manipulate pricing, devalue the dollar, and impose financial controls.

If governments amass enough Bitcoin, they could set legal precedents restricting private usage—via CBDCs, taxation, or outright bans—while hoarding Bitcoin for themselves.

4. Inflationary Escape Hatch for the State

Gold reserves allowed the government to stabilize its debt expansion post-Depression.

Bitcoin reserves give governments a lifeline as fiat currencies collapse, ensuring they survive financial turmoil at the expense of the public.

5. Pathway to a Fiat-Backed Bitcoin Standard

Just as gold was once the standard, Bitcoin could become a state-controlled backing for a new digital fiat system (CBDCs), not for individual freedom, but as a monetary weapon.

The Endgame: State Monopoly Over Bitcoin, Just Like Gold

If the government successfully hoards enough Bitcoin while suppressing private ownership, it can:

✔️ Dictate Bitcoin regulation and pricing

✔️ Tax transactions at will

✔️ Crush non-compliant alternatives (e.g., Monero, privacy coins, non-KYC Bitcoin use)

✔️ Enforce centralized custody via institutional products (e.g., BlackRock ETFs)

Just as gold went from a people’s store of value to a state-controlled asset, Bitcoin risks becoming state-captured digital gold, unless people resist custodial solutions and fight for self-custody.

History is repeating. The only question is—will people comply, or will they hold the keys this time?

1. Centralization Through Confiscation or Coercion

In 1933, Executive Order 6102 forced individuals to surrender gold, allowing the government to seize monetary control and inflate the dollar without resistance.

Today, governments accumulate Bitcoin through confiscations (Mt. Gox, Silk Road seizures), taxation, and custodial regulations, slowly centralizing supply.

2. Suppression of Private Self-Custody

In 1933, private gold ownership was criminalized, forcing people into fiat.

Governments today demonize self-custody, promoting KYC-heavy, custodied Bitcoin solutions (ETFs, custodial wallets, regulated exchanges)—ensuring they have ultimate control.

3. Legal & Regulatory Capture

Once the U.S. centralized gold, it was easy to manipulate pricing, devalue the dollar, and impose financial controls.

If governments amass enough Bitcoin, they could set legal precedents restricting private usage—via CBDCs, taxation, or outright bans—while hoarding Bitcoin for themselves.

4. Inflationary Escape Hatch for the State

Gold reserves allowed the government to stabilize its debt expansion post-Depression.

Bitcoin reserves give governments a lifeline as fiat currencies collapse, ensuring they survive financial turmoil at the expense of the public.

5. Pathway to a Fiat-Backed Bitcoin Standard

Just as gold was once the standard, Bitcoin could become a state-controlled backing for a new digital fiat system (CBDCs), not for individual freedom, but as a monetary weapon.

The Endgame: State Monopoly Over Bitcoin, Just Like Gold

If the government successfully hoards enough Bitcoin while suppressing private ownership, it can:

✔️ Dictate Bitcoin regulation and pricing

✔️ Tax transactions at will

✔️ Crush non-compliant alternatives (e.g., Monero, privacy coins, non-KYC Bitcoin use)

✔️ Enforce centralized custody via institutional products (e.g., BlackRock ETFs)

Just as gold went from a people’s store of value to a state-controlled asset, Bitcoin risks becoming state-captured digital gold, unless people resist custodial solutions and fight for self-custody.

History is repeating. The only question is—will people comply, or will they hold the keys this time?

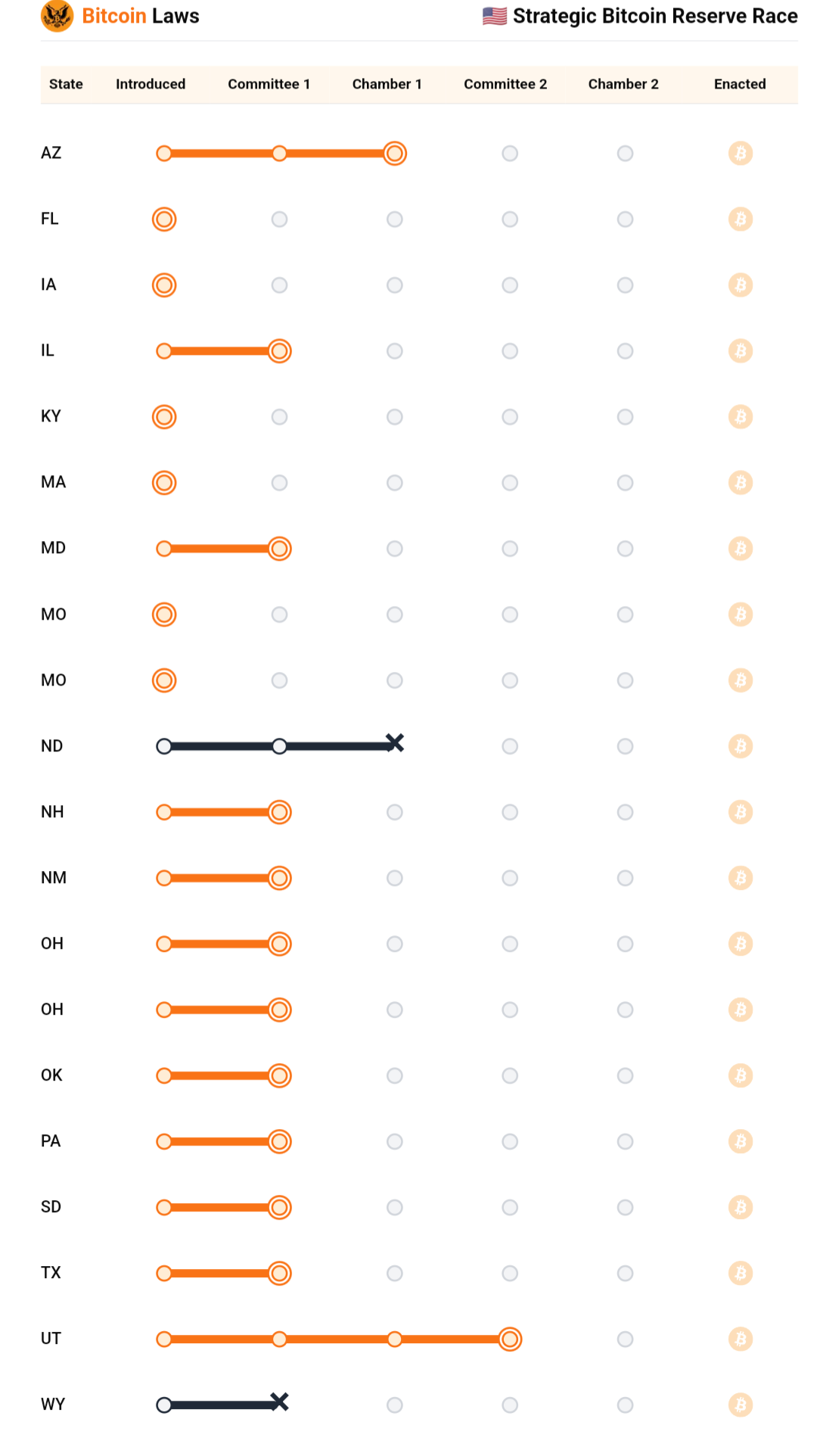

quoting nevent1q…zte0Which state is going to win the Bitcoin Reserve race?